oklahoma auto sales tax rate

Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle. The Motor Vehicle Excise Tax on a new vehicle sale is 325.

Should You Be Charging Sales Tax On Your Online Store Payroll Taxes Income Tax Tax Write Offs

There are special tax rates and conditions for used vehicles which we will cover later.

. The make model and year of your vehicle. Just enter the five-digit zip. Your exact excise tax can only be calculated at a Tag Office.

Oklahoma has long split off its sales tax on vehicles from the general sales tax on other property. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. The date that you.

Now Oklahomans purchasing a vehicle will have to pay a 125 percent tax on top of the 325 percent excise tax. Each city and county charges their own sales tax rate in Oklahoma in addition to the statewide sales tax. 31 rows The state sales tax rate in Oklahoma is 4500.

Exact tax amount may vary for different items. 775 for vehicle over. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325.

325 of ½ the actual purchase pricecurrent value. The sales tax rate for the Sooner City is 45 however for most road vehicles there is a Motor Vehicles Excise Tax assessed at the time of sale or when the new Oklahoma car title is issued in the new owners name. The tax on vehicles called the excise tax does not apply to vehicles with a.

How on earth do. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. The information you may need to enter into the tax and tag calculators may include.

This is the largest of Oklahomas selective. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242. The cost for the first 1500 dollars is a flat 20 dollar fee.

This is only an estimate. Counties and cities can charge an. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

The cost for the first 1500 dollars is a flat 20 dollar fee. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

325 of taxable value which decreases by 35 annually. Removing that exemption is expected to generate 123 million. This method is only as exact as the purchase price of the vehicle.

With local taxes the total sales tax. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad. You did not pay a sales tax on it you paid an excise tax and the tax rate is not the same as the general sales tax rate.

Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. Sales tax is based on the buyers location. States with high tax rates tend to be above 10 of the price of the.

The vehicle identification number VIN. 635 for vehicle 50k or less. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Office 918591-3099 fax 918 591-3098 Email us.

Virginia Vehicle Sales Tax Fees Calculator

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Is Buying A Car Tax Deductible Lendingtree

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets Continuing Education

Virginia Vehicle Sales Tax Fees Calculator

Understanding California S Sales Tax

Virginia Sales Tax On Cars Everything You Need To Know

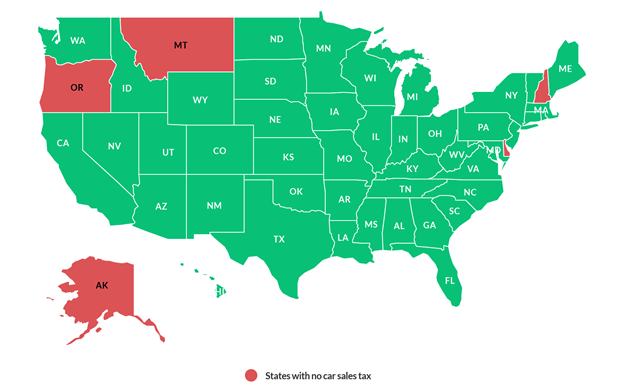

What S The Car Sales Tax In Each State Find The Best Car Price

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

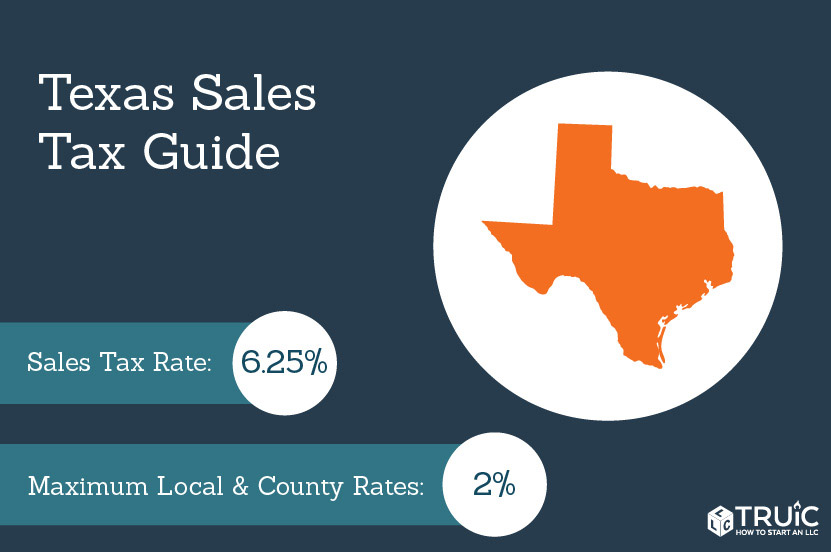

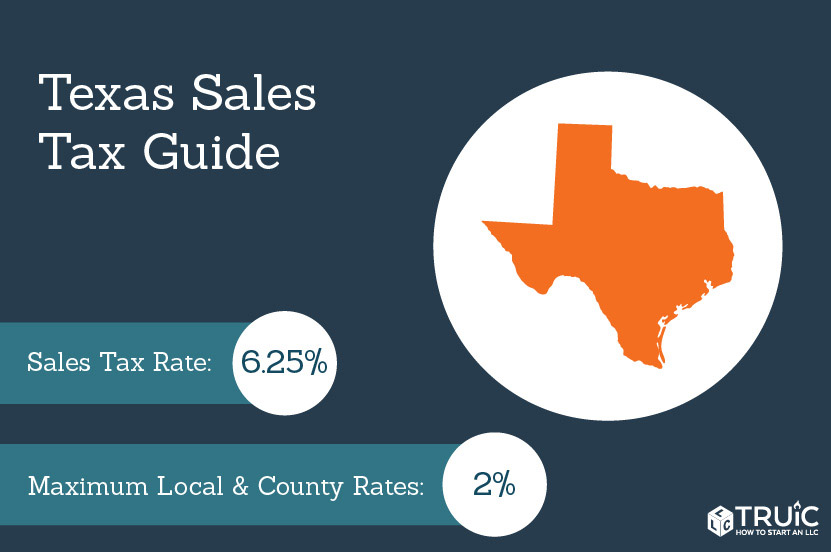

Texas Sales Tax Small Business Guide Truic

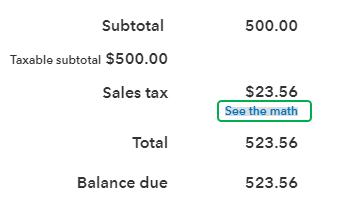

How To Calculate Sales Tax For Your Online Store

6 Differences Between Vat And Us Sales Tax

States With Highest And Lowest Sales Tax Rates

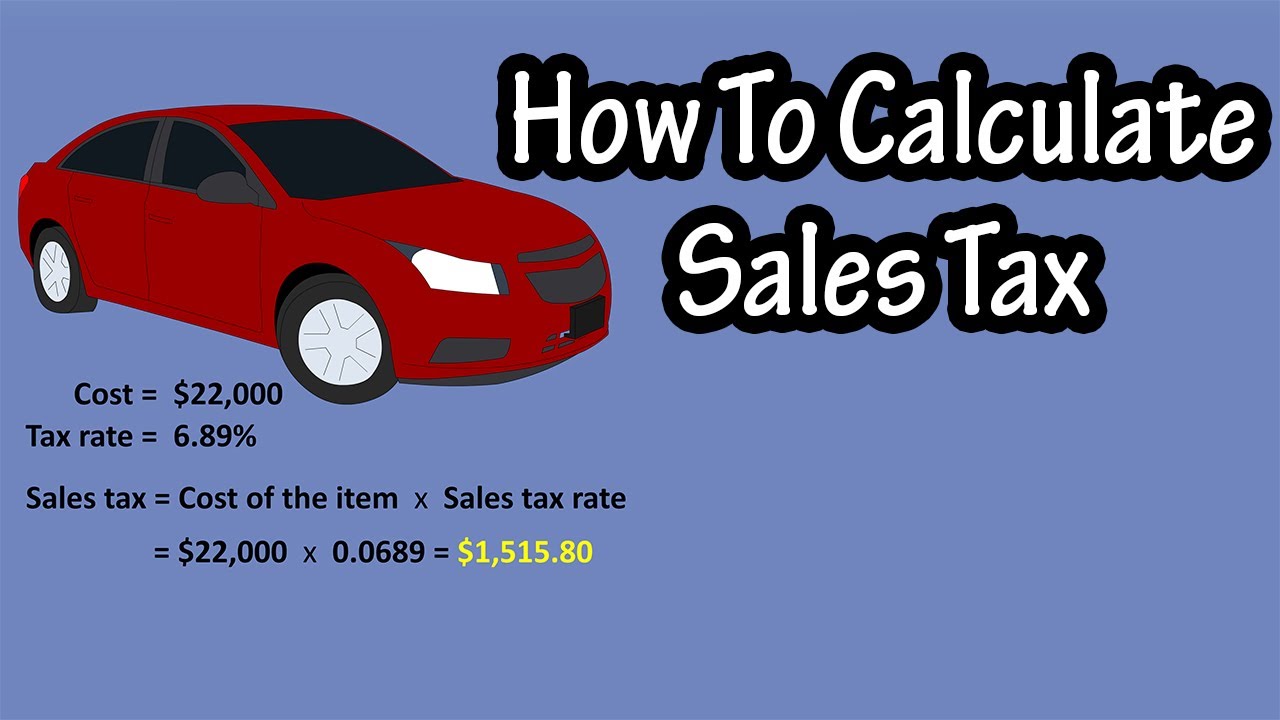

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Which U S States Charge Property Taxes For Cars Mansion Global